What's the fate of US mortgage rates amid this chaos?

From CNN's Jeanne Sahadi, Michelle Toh, Danielle Wiener-Bronner and Allison Morrow

Single family homes are seen in a residential neighborhood in Miramar, Florida, on October 27, 2022. (Joe Raedle/Getty Images/FILE)

Single family homes are seen in a residential neighborhood in Miramar, Florida, on October 27, 2022. (Joe Raedle/Getty Images/FILE)The banking meltdown over the past week has left us with more questions than answers. The stunning collapse of two American banks and the loss of investor confidence in Credit Suisse led to wild market swings and put Wall Street on edge.

During CNN’s primetime special, “Bank Bust: Inside the Collapse of SVB,” experts weighed in on how to best understand what’s happening in a rapidly developing and confusing environment for financial institutions.

With all the panic in the market, it gets tougher to purchase a home, particularly if government regulators like the Federal Reserve crack down on banks in the wake of SVB’s collapse. The Fed has also been on a historic rate-hiking regime to keep inflation in check, and most economists expect that to continue.

“I think realistically, from what we’ve heard from the Fed, interest rates likely will continue to rise,” said Vivian Tu, a former JPMorgan trader.

“On top of that, I think a lot of folks are feeling very concerned about, ‘Hey, if I’m saving up for a down payment, is a bank a safe place to put that money?’”

The 30-year fixed-rate mortgage averaged 6.73% in the week ending March 9. A year ago, it was 3.85%.

Freddie Mac is set to release its average weekly mortgage rates at 12 p.m. ET on Thursday.

Credit Suisse shares surge at open after agreeing loan from Swiss central bank

From CNN's Robert North

Shares in Credit Suisse have surged in the opening minutes of trading after it agreed a $53 billion loan from the Swiss central bank.

Switzerland’s second largest bank was up more than 30% in early trade.

On Wednesday the bank plunged more than 24% to a record low after its biggest shareholder said it had no plans to give any more funds to Credit Suisse.

Overnight the Swiss central bank and the Swiss regulator said they were ready to provide financial support to Credit Suisse, and the bank took up the offer, saying the loan was a "decisive action to pre-emptively strengthen its liquidity."

European markets open higher after Credit Suisse takes up Swiss central bank support

From CNN's Robert North

The London Stock Exchange Group logo outside their offices on Tuesday. (Hollie Adams/Bloomberg/Getty Images/FILE)

The London Stock Exchange Group logo outside their offices on Tuesday. (Hollie Adams/Bloomberg/Getty Images/FILE)Europe’s main markets have opened higher after moves from the Swiss central bank reassured investors over the financial health of Credit Suisse.

In the opening minutes of trade the UK’s FTSE 100 was up more than 1% and the French CAC 40 was up 1.5%.

Switzerland’s second largest bank has agreed to a $53 billion loan from the Swiss central bank, saying it was a "decisive action to pre-emptively strengthen its liquidity."

What is this "moral hazard" thing?

From CNN's Jeanne Sahadi, Michelle Toh, Danielle Wiener-Bronner and Allison Morrow

You may hear economists and market analysts reference “moral hazard” when discussing the past weekend’s rescue of two US banks, Silicon Valley Bank and Signature.

“Moral hazard” is somewhat academic shorthand for the idea that banks (or other entities) will take on more risk if they believe that they will ultimately be bailed out.

For example, some argue that SVB should have been allowed to fail — that the pain of the fallout would outweigh the downsides of customers losing their money and startups going out of business.

Of course, others note that the risk of letting the 16th-largest US bank collapse, and potentially letting its tech industry customers also fail, could have far-reaching and potentially devastating consequences.

Why did SVB get special treatment?

From CNN's Jeanne Sahadi, Michelle Toh, Danielle Wiener-Bronner and Allison Morrow

An armored truck sits parked in front of the shuttered Silicon Valley Bank headquarters in Santa Clara, California, on March 10. (Justin Sullivan/Getty Images)

An armored truck sits parked in front of the shuttered Silicon Valley Bank headquarters in Santa Clara, California, on March 10. (Justin Sullivan/Getty Images)The banking meltdown over the past week has left us with more questions than answers. The stunning collapse of two American banks and the loss of investor confidence in Credit Suisse led to wild market swings and put Wall Street on edge.

During CNN’s primetime special, “Bank Bust: Inside the Collapse of SVB,” experts weighed in on how to best understand what’s happening in a rapidly developing and confusing environment for financial institutions.

After Silicon Valley Bank failed on Friday, its customers were filled with fear. But by Monday, they could breathe a sigh of relief — the Treasury Department, the Federal Reserve and the Federal Deposit Insurance Corporation had said over the weekend that each customer would be made whole, even beyond the $250,000 insured by the FDIC.

While it was welcome news for account holders, the extraordinary move raised questions for some, who wondered why the FDIC bent its rules for SVB and its customers.

As to why the FDIC made the decision it did? The Federal government didn’t want SVB’s failure to “have a domino effect,” Khalfani-Cox said. “Federal regulators deemed them to be in the category of ‘systemic risk,’ so they granted an exemption.”

Credit Suisse deal doesn't mean the "panic" is over, analyst says

From CNN's Juliana Liu

Ryan Patel. CNN

Ryan Patel. CNNAsian markets pared some losses on Thursday after Credit Suisse said it would borrow up to 50 billion Swiss Francs ($53.7 billion) from the Swiss National Bank, as it seeks to reassure investors it has the necessary cash to stay afloat.

But Ryan Patel, a senior fellow at the Drucker School of Management at Claremont Graduate University, said the “panic” over the Swiss banking giant isn’t going away anytime soon.

The failure last week of Silicon Valley Bank and Signature, two much smaller regional lenders, shook investor confidence around the world. Some analysts have even compared SVB to Bear Stearns, the first lender to collapse at the start of the 2007-2008 global financial crisis.

However, Patel said regulations imposed on the banking sector after 2008 should be enough to prevent a repeat of the global financial crisis.

Chinese banks advance, even as their overseas peers take a plunge

From CNN's Laura He

The Shanghai Pudong Development Bank Co. is seen on Tuesday. (Qilai Shen/Bloomberg/Getty Images)

The Shanghai Pudong Development Bank Co. is seen on Tuesday. (Qilai Shen/Bloomberg/Getty Images)Some analysts are calling China a “safe harbor” amid the turmoil.

In Shanghai, the nation’s biggest state-owned lenders all rallied.

Bank of China was up 2.7%. Agricultural Bank of China and ICBC both gained 1.6%. China Construction Bank and Bank of Communications added 1.3% and 0.6%, respectively.

In Hong Kong, Bank of China rose 1%. Agricultural Bank of China was up 0.7%, and Bank of Communications edged 0.2% higher.

Jefferies analysts said Wednesday that China could be a “safe harbor” for investors as the country’s economy is “undoubtedly in a recovery.” The latest economic data from January and February confirmed a rebound is on track, they said.

On the same day, Goldman Sachs raised its forecast for China’s GDP growth to 6% in 2023, up from 5.5% previously. It’s their second upgrade this year.

They cited China’s “rapid reopening” after three years of Covid restrictions and solid economic data from the first two months of this year.

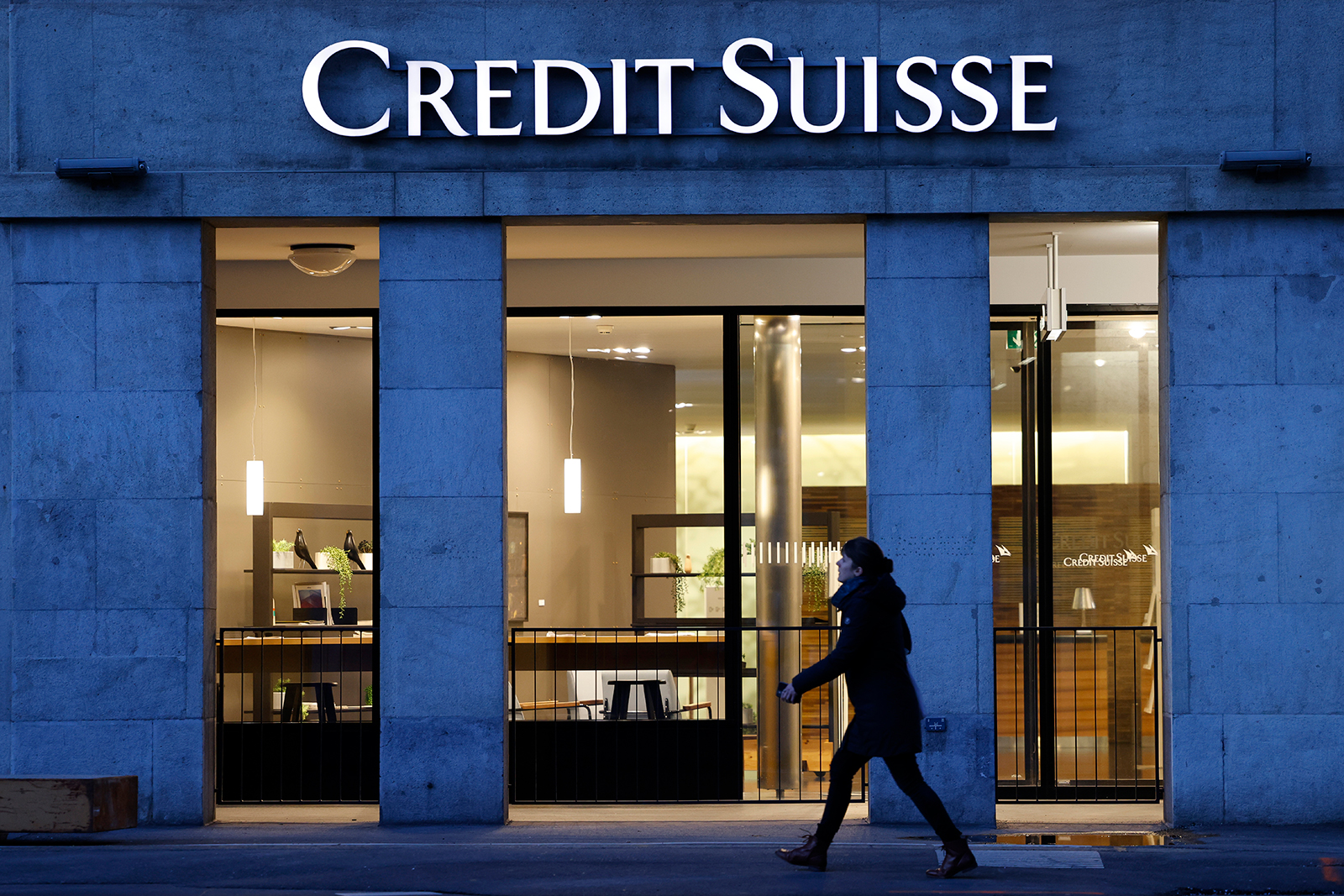

Why are people worrying about Credit Suisse? The bank is "systemically important"

From CNN's Allison Morrow

A Credit Suisse Group AG office building at night in Bern, Switzerland, on March 15. (Stefan Wermuth/Bloomberg/Getty Images)

A Credit Suisse Group AG office building at night in Bern, Switzerland, on March 15. (Stefan Wermuth/Bloomberg/Getty Images)It’s hard to overstate how big of a deal it would be for Credit Suisse — with its half-a-trillion dollars in assets and more than 50,000 employees around the world — to collapse.

The failure last week of Silicon Valley Bank and Signature, two much smaller regional lenders, shook investor confidence around the world.

Credit Suisse, one the largest lenders in Europe, is “much more globally interconnected, with multiple subsidiaries outside Switzerland, including in the US,” wrote Andrew Kenningham, chief Europe economist at Capital Economics.

Credit Suisse is not just a Swiss problem but a global one.”

Credit Suisse is known as a “global systemically important bank,” (or “G-SIB,” as the cool kids call it).

Once one of those mega-banks is in trouble, people start to wonder what’s going on with the system and speculate about who might be the next to fall.

Even with a financial lifeline from Swiss authorities, there are still plenty of risks and unknowns radiating out from Credit Suisse, keeping investors on edge.

Credit Suisse turmoil indicates the crisis has not been contained, according to Arthur Wilmarth, professor at the George Washington School of Law.

Read more here.

This isn't the first time banking giant Credit Suisse has faced troubles in its 167-year history

From CNN's Hanna Ziady and Michelle Toh

Credit Suisse has been dogged by problems for years. In fact, it faced rumors of a potential collapse as recently as late last year.

In October, social media chatter that the Swiss bank was on the brink of going bust sent shares on a wild ride.

It also appeared to cost the firm dearly: Customers withdrew 111 billion Swiss francs ($121 billion) in the final three months of 2022 amid the speculation.

Credit Suisse has since embarked on a massive turnaround plan that will see it slash 9,000 full-time jobs by the end of 2025. The firm will also spin off its investment bank and focus more on wealth management.

But last month, the Zurich-based lender reported its biggest annual loss since the financial crisis in 2008, highlighting the scale of the challenge it continues to face.

It lost 7.3 billion Swiss francs ($7.9 billion) in 2022, compared to a loss of 8.2 billion Swiss francs ($8.9 billion) in 2008.

The dismal results followed a series of missteps and compliance failures that have already cost the bank dearly.

For example, the collapse of US hedge fund Archegos Capital Management, a client of Credit Suisse, in 2021 cost the bank $5.5 billion. An independent external investigation later found "a failure to effectively manage risk."

Last year, the bank's chairman also resigned following an investigation commissioned by the board that reportedly looked at claims that he broke Covid-19 rules. The inquiry was said to focus on conduct including travel and his personal use of corporate aircraft.

The bank's reputation has also been marred by a spying scandal in recent years, which ultimately led to the resignation of its former CEO and COO.

New deal: Credit Suisse said Wednesday it would borrow up to 50 billion Swiss Francs ($53.7 billion) from the Swiss National Bank, as it seeks to reassure investors it has the necessary cash to stay afloat. Investors sent shares in the country’s second biggest lender crashing by as much as 30% Wednesday.

.png)

1 year ago

8

1 year ago

8

English (US) ·

English (US) ·