The IRS does not contact taxpayers through email and stimulus checks are no longer being issued in 2023. This is a phishing scam.

In 2020 and 2021, the federal government sent out three rounds of economic impact payments, also known as stimulus checks, to provide financial relief to many Americans during the COVID-19 pandemic.

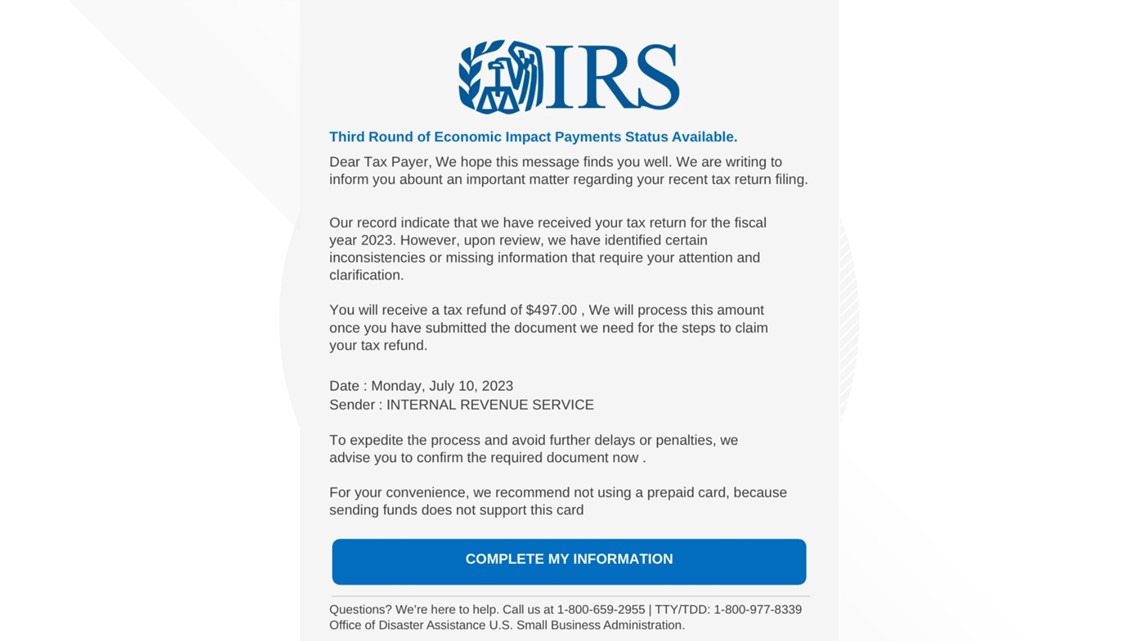

But several VERIFY viewers, including Felacia, have messaged our team saying they have recently received emails claiming to be from the IRS with a subject line that reads: “Third Round of Economic Impact Payments Status Available.”

The emails allege that the recipients will be able to claim a 2023 tax refund if they provide missing information and submit a document to what appears to be the IRS as soon as possible. Our viewers want to know if these emails are legitimate.

THE QUESTION

Is the IRS sending emails to taxpayers about a third round of economic impact payments?

THE SOURCES

THE ANSWER

![]()

No, the IRS is not sending emails to taxpayers about a third round of economic impact payments. This is a phishing scam.

WHAT WE FOUND

In May 2023, right after the end of tax season, the IRS issued warnings to taxpayers about online scammers who had been fraudulently using the IRS name or logo in fake emails in order to steal people’s identity through a type of scam known as phishing.

“Current scams include phony emails which claim to come from the IRS and which lure the victims into the scam by telling them that they are due a tax refund,” the IRS wrote on its website.

First, these phony emails claim that the IRS is going to provide the status of a third round of economic impact payments. But this is false.

The Federal Trade Commission (FTC) and the IRS say identity thieves have been using economic impact payments to trick people into providing their personal or financial information as far back as October 2021. However, these payments are no longer being issued by the IRS in 2023. That’s because The American Rescue Plan Act of 2021 required the third and final round of economic impact payments to be issued by Dec. 31, 2021.

Second, these phishing emails claim taxpayers are entitled to a tax refund after they provide the IRS with missing information by clicking the link at the bottom of the email that reads “complete my information.” But that’s not how the IRS handles tax refunds.

The IRS says if it needs more information from a taxpayer, it will send them a letter through the regular mail. That’s because the IRS does not initiate contact with taxpayers via email, text message or social media channels to request personal or financial information.

The IRS says it typically issues tax refunds within 21 days after a federal income tax return has been filed. But as of July 17, 2023, the agency says it is experiencing delays in processing returns.

“This work does not typically require us to correspond with taxpayers, but it does require special handling by an IRS employee, so in these instances, it is taking the IRS more than 21 days to issue any related refund,” the IRS says on its website.

If you have received an email claiming to be from the IRS that contains a request for personal information, the IRS says you should follow these tips:

- Don't reply.

- Don't open any attachments. These can contain malicious code that may infect your computer or mobile phone.

- Don't click on any links. Visit the IRS identity protection page if you clicked on links in a suspicious email or website and entered confidential information.

- Forward (preferably with the full email headers) the email as-is to the IRS at phishing@irs.gov. Don't forward scanned images because this removes valuable information.

- Delete the original email.

“Any text messages, random incoming phone calls or emails inquiring about bank account information, requesting recipients to click a link or verify data should be considered suspicious and deleted without opening. This includes not just stimulus payments, but tax refunds and other common issues,” the IRS says.

You can find the most up-to-date information about your tax refund status by using the Where’s My Refund? tool on the IRS website. The Where’s My Refund? tool has a tracker that displays progress through 3 stages: (1) Return Received, (2) Refund Approved and (3) Refund Sent.

If you have experienced any financial losses due to an IRS-related scam incident, you can report it to the Treasury Inspector General for Tax Administration (TIGTA) and file a complaint with the FTC.

The VERIFY team works to separate fact from fiction so that you can understand what is true and false. Please consider subscribing to our daily newsletter, text alerts and our YouTube channel. You can also follow us on Snapchat, Twitter, Instagram, Facebook and TikTok. Learn More »

Follow Us

Want something VERIFIED?

Text: 202-410-8808

.png)

English (US) ·

English (US) ·