Here's how the government can guarantee customer deposits without using taxpayer money

From CNN's Alicia Wallace

A pedestrian walks outside the headquarters of the U.S. Federal Deposit Insurance Corp., in May 2009. (Brendan Hoffman/Bloomberg/Getty Images)

A pedestrian walks outside the headquarters of the U.S. Federal Deposit Insurance Corp., in May 2009. (Brendan Hoffman/Bloomberg/Getty Images)Banks, not taxpayers, are funding the government's efforts to shore up depositors of the failed Silicon Valley Bank and Signature Bank.

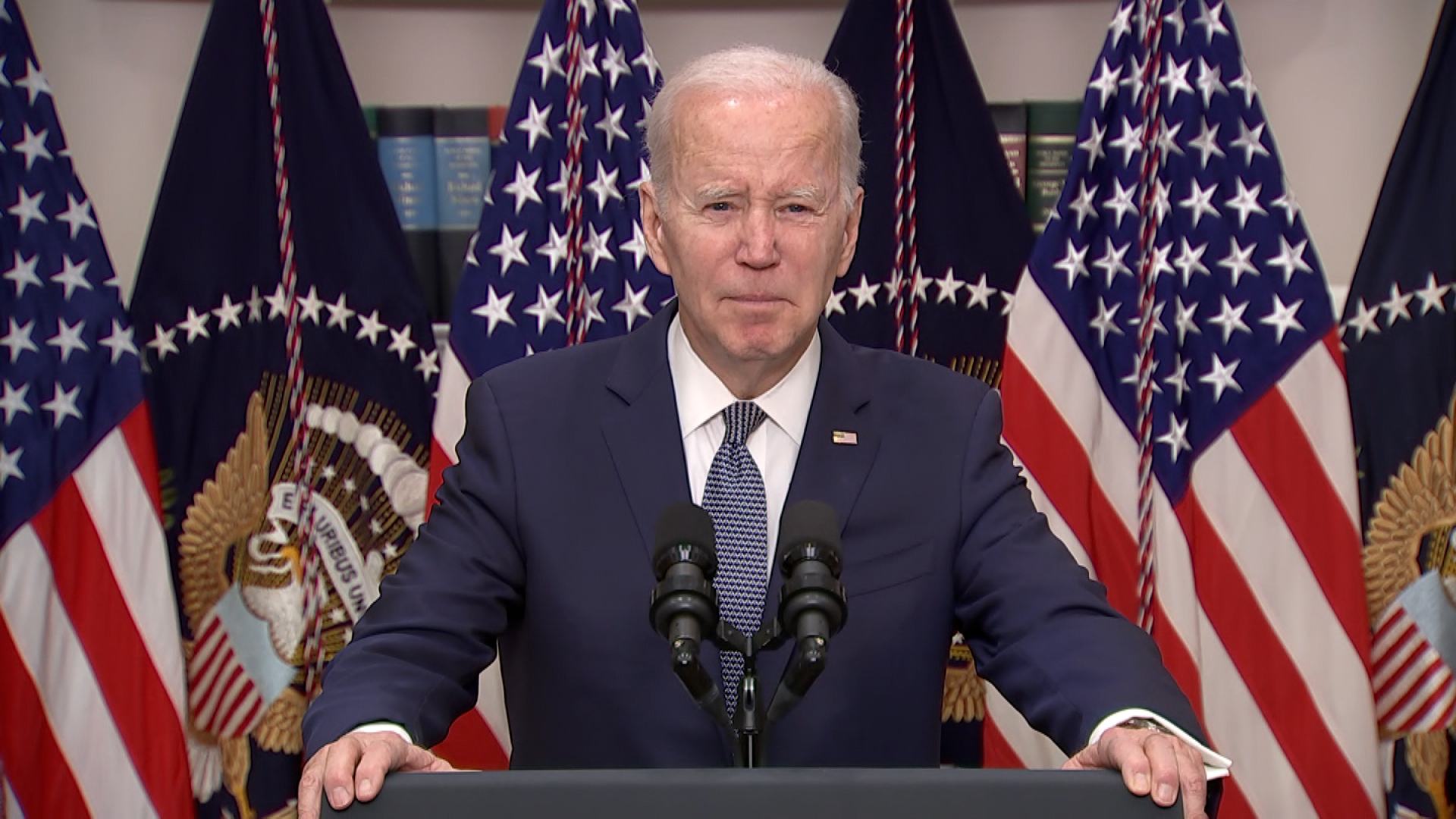

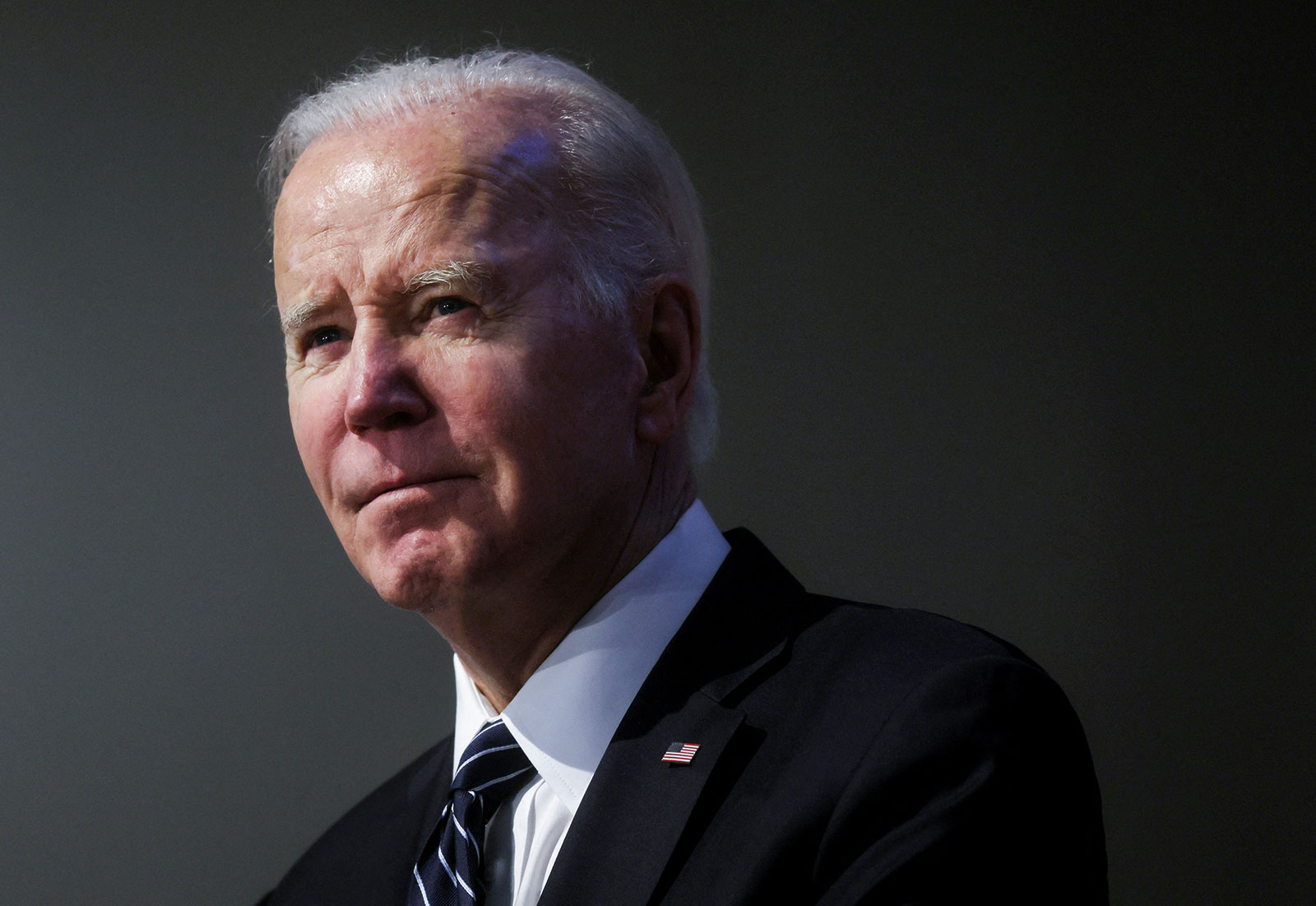

The Biden administration will draw from the Deposit Insurance Fund to backfill customers' deposits, President Joe Biden said Monday, reiterating comments from the heads of Treasury, the Federal Reserve and the Federal Deposit Insurance Corporation that this relief plan would not be funded by American taxpayers.

"No losses will be — and this is an important point — no losses will be borne by the taxpayers; let me repeat that, no losses will be borne by the taxpayer," Biden said Monday in remarks delivered from the White House. "Instead the money will come from the fees that banks pay into the Deposit Insurance Fund."

The FDIC's Deposit Insurance Fund (DIF) is used to help pay for operating costs as well as to resolve failed banks. It's funded by quarterly fees collected from FDIC-insured banks as well as interest earned from its investments in Treasury securities.

As of December 31, 2022, the DIF's fund balance was $128.2 billion, according to the FDIC.

Under requirements put in place by the Dodd-Frank Act, the FDIC has to have enough in the DIF coffers to cover 1.35% of insured deposits.

EU Commission monitoring Silicon Valley Bank collapse

From CNN’s Olivia Dey

The European Union Commission is monitoring the situation following Friday's collapse of Silicon Valley Bank, the biggest failure of a US bank since 2008, a spokesperson said.

Dow opens more than 200 points lower as bank stocks plummet

CNN's Nicole Goodkind

Traders work on the floor of the New York Stock Exchange today during morning trading. (Timothy A. Clary/AFP/Getty Images)

Traders work on the floor of the New York Stock Exchange today during morning trading. (Timothy A. Clary/AFP/Getty Images)US stocks opened lower Monday as traders digested the plan by federal banking regulators to make the depositors in the failed Silicon Valley Bank whole and provide additional funding for other banks.

Stock futures popped on Sunday after the deal was announced, but quickly fell on Monday as fear rippled through markets that the government may not have done enough to restore confidence in the US banking system.

Shares of US banks, particularly regional banks, dropped in early trading Monday.

JPMorgan Chase was down 2% and Citigroup fell by 3.4%. Regional lenders notched some of the largest drops in the market. First Republic Bank was down more than 65%, Western Alliance Bancorp sank 73% and PacWest Bancorp fell 35.5%.

President Joe Biden delivered remarks Monday to assure Americans that the banking system is safe after the collapse of Silicon Valley Bank and Signature Bank but added that investors in bank stocks would not be protected. "They knowingly took a risk and when the risk didn't pay off investors lose their money. That's how capitalism works," he said.

2-year Treasury yields, meanwhile, have fallen more than 100 points since Wednesday and are on track to notch their largest three-day drop since Black Monday in October 1987.

The sudden outbreak of financial trouble at US regional banks, meanwhile, has led Goldman Sachs economists to forecast that the Federal Reserve will pause rate hikes at its policy meeting next week. The probability of no hike was at about 22% on Monday morning (though the number was moving quickly and swinging with great volatility), according to the CME FedWatch Tool, up from 0% on Friday.

The Dow was down 243 points, or 0.8%, on Monday morning.

The S&P 500 fell by 1.1%.

The Nasdaq Composite was 0.9% lower.

Taxpayers will not suffer any losses, Biden says as he details actions to keep the banking system safe

From CNN's Aditi Sangal

US President Joe Biden speaks about the US banking system today in the Roosevelt Room of the White House in Washington, DC. (Saul Loeb/AFP/Getty Images)

US President Joe Biden speaks about the US banking system today in the Roosevelt Room of the White House in Washington, DC. (Saul Loeb/AFP/Getty Images)President Joe Biden addressed the nation Monday to assure Americans that the banking system is safe after the collapse of Silicon Valley Bank and Signature Bank. In his speech, he highlighted the immediate action that his administration has taken.

Customers' deposits will be protected: Customers will "have access to their money as of today. That includes small businesses across the country that bank there and need to make payroll, pay their bills and stay open for business," Biden said, adding that no losses will be suffered by the taxpayers.

"Instead, the money will come from the fees that banks pay into the deposit insurance fund," he explained.

The management of these banks will be fired: "If the bank is taken over by FDIC, the people running the bank should not work there anymore," Biden said.

Investors in the banks will not be protected: "They knowingly took a risk and when the risk didn't pay off, investors lose their money. That's how capitalism works," Biden added.

Logging a full account of what happened: Biden stressed the importance of holding those responsible accountable. "In my administration, no one is above the law," he said.

Reducing the risk of this happening again: Citing the requirements put in place during the Obama administration, including the Dodd-Frank Act, Biden said there were rules in place to prevent a repeat of 2008. But he added that the Trump administration rolled some of these regulations back.

"I'm going to ask Congress and the banking regulators to strengthen the rules for banks, to make it less likely this kind of bank failure would happen again," he said. "And to protect American jobs and small businesses."

Reassuring that while the banking system is safe, he also said the administration will not stop at this.

Biden: Small businesses can "breathe easier knowing they'll be able to pay their workers"

From CNN's Aditi Sangal

US President Joe Biden on Monday addressed the nation after the collapses of Silicon Valley Bank and Signature Bank, and said, "Americans can have confidence that the banking system is safe."

Biden plans to emphasize US banking system is "safe" in his Monday remarks

From CNN's MJ Lee

(Pool)

(Pool)When President Joe Biden speaks in the next hour following the dramatic actions his administration last night to try to contain Silicon Valley Bank’s collapse, he plans to emphasize that the US banking system is “safe,” according to a White House official.

“The president will tell Americans they can have confidence that our banking system is safe, and their deposits will be there when they need them,” the White House official said.

The remarks, which were announced last night, will be an effort by Biden himself to directly explain to the public what exactly he has instructed his administration to do to protect small businesses and workers in particular.

The actions he’ll emphasize include backstopping depositors’ funds, taxpayers not being on the hook for these moves, holding those responsible accountable and not extending relief to investors of Silicon Valley Bank.

It remains to be seen how exactly Biden plans to hold those responsible “accountable” – and who he deems responsible for the collapses.

Banking stocks slump despite moves to protect Silicon Valley Bank’s customers

From CNN's Anna Cooban

Investors are dumping bank stocks Monday, extending Friday’s losses, despite dramatic weekend moves by the US and UK governments to shore up confidence in the financial system following the collapse of Silicon Valley Bank.

The Biden administration said Sunday that it would guarantee all SVB’s deposits held by American customers, while the British government helped orchestrate the sale of SVB UK to global banking giant HSBC, averting its insolvency.

- Europe's benchmark Stoxx Europe 600 Banks index, which tracks 42 big EU and UK banks, fell 5.6% in morning trade — notching its biggest fall since June.

- The broader Stoxx Europe 600 index dropped 2%.

- The bank-heavy FTSE 100 slid 1.8%.

- Shares in embattled Swiss banking giant Credit Suisse were down 11.3%.

The shares of other major European banks were also being dumped: Barclays fell 4.2%, Deutsche Bank 5.5% and Italy's Unicredit 7.5%.

Smaller US banks were even worse off. Shares in First Republic and PacWest Bancorp cratered 60% and 35% respectively in pre-market trading.

The falls have heightened fears that the second-biggest banking collapse in US history may be sparking contagion in the sector that could lead to further failures.

“Investors have still been shaken by the events of the past few days," aid Susannah Streeter, head of money and markets at investing platform Hargreaves Lansdown, adding that investors are waiting to see if there will be a spillover, creating a pool of fresh problems.

“The pre-market freefall of shares in First Republic bank in the US has added heightened worry to those concerns. There is expectation that weaknesses remain in pockets of the system and the US Treasury may have to step in with further guarantees of deposits at other banks and at least lift the ceiling of the insured deposit guarantees,” she said.

Fed will pause rate hikes at meeting next week, says Goldman Sachs

From CNN's Nicole Goodkind

Federal Reserve Chair Jerome Powell testified before the Senate Banking Committee on March 7 in Washington, DC. (Win McNamee/Getty Images)

Federal Reserve Chair Jerome Powell testified before the Senate Banking Committee on March 7 in Washington, DC. (Win McNamee/Getty Images)Just last week, markets were convinced that Federal Reserve Chairman Jerome Powell had opened the door to an aggressive half-point interest rate hike at the central bank's policy meeting next week.

On Monday, Wall Street attempted to close that door.

Citing the sudden outbreak of financial trouble at US regional banks, Goldman Sachs economists wrote in a note Monday that they no longer expect the Fed to deliver a rate hike at all.

The probability of no hike was at about 30% in pre-market trading Monday (though the number was moving quickly and swinging with great volatility), according to the CME FedWatch Tool, up from 0% on Friday.

That's because many on Wall Street believe that the Fed's aggressive regimen of rate hikes has undercut the value of bonds and could trigger a recession. They blame the current tightening cycle for the regional banking crisis spurred by rapid withdrawals from Silicon Valley Bank and Signature Bank.

Goldman Sachs had previously predicted that the Fed would raise interest rates by a quarter point at its meeting next week, but Goldman’s Jan Hatzius wrote in a note Monday that there was now “considerable uncertainty” about the central bank's path forward.

While calls have increased for the Fed to pause its tightening cycle, "the reality is somewhat more complex, and those betting on the Fed to end its tightening cycle early because of current banking sector stress may be misguided," wrote EY Chief Economist, Gregory Daco. He's projecting that the Fed will hike interest rates by a quarter point next week.

Michael Feroli, chief US economist at JPMorgan Chase, also wrote on Sunday that he was expecting a quarter-point rate hike.

The Federal Reserve, meanwhile, has entered the quiet period ahead of its policy meeting next week and cannot comment or issue guidance on the way forward.

Additionally, 2-year Treasury yields tumbled by half a percentage point Monday morning to just under 4.1% and are on pace to hit their largest three-day decline since Black Friday in October 1987.

Biden will speak about US banking system and Silicon Valley Bank collapse soon from the White House

From CNN's Sam Fossum and Aaron Pellish

US President Joe Biden delivers remarks in Washington, DC, on March 1. (Leah Millis/Reuters)

US President Joe Biden delivers remarks in Washington, DC, on March 1. (Leah Millis/Reuters)President Joe Biden is set to address the developing situation in the US banking system at 9 a.m. ET, according to the pool.

"Yes. I'll talk to you tomorrow morning," Biden told reporters Sunday in response to a question about addressing the situation as he boarded Air Force One to return to the White House.

Biden will deliver remarks before departing for San Diego where he is scheduled to meet the prime ministers of the United Kingdom and Australia.

.png)

1 year ago

17

1 year ago

17

English (US) ·

English (US) ·