The U.S. has never defaulted before over failure to raise the debt ceiling and there is no framework for prioritizing certain payments over others.

If Congress doesn’t lift the debt ceiling, the U.S. Treasury won’t be able to borrow funds to pay bills Congress previously approved, causing the country to default on its financial obligations.

Treasury Secretary Janet Yellen estimated that could happen as soon as June 1.

The result could spell economic catastrophe – the precise nature of which is unknown, but could include everything from delayed or reduced Social Security checks to the nation’s credit rating being downgraded, a signal investors have lost trust in the U.S. economy.

Several VERIFY viewers wanted to know whether members of Congress, who are paid by the federal government, would still receive their paychecks in the event of a default.

THE QUESTION

If the U.S. defaults, will members of Congress still be paid their salaries?

THE SOURCES

THE ANSWER

![]()

It is unclear who would be paid and who would not. The U.S. has never defaulted before over failure to raise the debt ceiling, and there is no legal or technical framework for prioritizing certain payments over others.

WHAT WE FOUND

The United States has never defaulted on its obligated payments over failure to raise the debt ceiling, meaning there is no precedent for what happens next if the debt limit isn’t lifted.

Unable to borrow money, the Treasury will only be able to pay bills using whatever cash it has on hand from recently-collected revenue. The department has already been using various accounting maneuvers to extend the amount of cash on hand, called “extraordinary measures,” but there are only so many moves it can make before all available funds are gone.

As new revenue like tax money continues to come in, the Treasury will have money to pay some bills, but not enough to cover all of them. That puts everything from federal employee paychecks to Social Security payments at risk.

So which bills get paid? Nobody – including the people who run the system – knows.

First off, there’s no precedent or legal framework that allows the Treasury to pick and choose certain bills to pay. They’re all due, when they’re due.

“[Treasury] has no legal authority to prioritize one payment over another,” wrote Richard Kogan, a senior fellow at the Center on Budget and Policy Priorities.

In the past some members of Congress have proposed to change that, introducing “prioritization” bills that would instruct Treasury whom to pay first. But experts say such proposals are impractical.

Testifying before the Senate Finance Committee in 2013, amid a debt ceiling standoff during President Obama’s second term, then-Secretary of the Treasury Jack Lew told Congress it isn’t logistically possible to prioritize some bills over others.

“We write, roughly, 80 million checks a month. The systems are automated… because, for 224 years the policy of Congress and every President has been: we pay our bills,” he said. “You cannot go into those systems and easily make them pay some things and not other things. They were not designed that way, because it was never the policy of this government to be in the position that we would have to be in if we could not pay all our bills.”

That means in a default scenario, who gets paid may simply be up to chance. Which revenues happen to enter which accounts at which times will determine which automated payments will actually be able to be made.

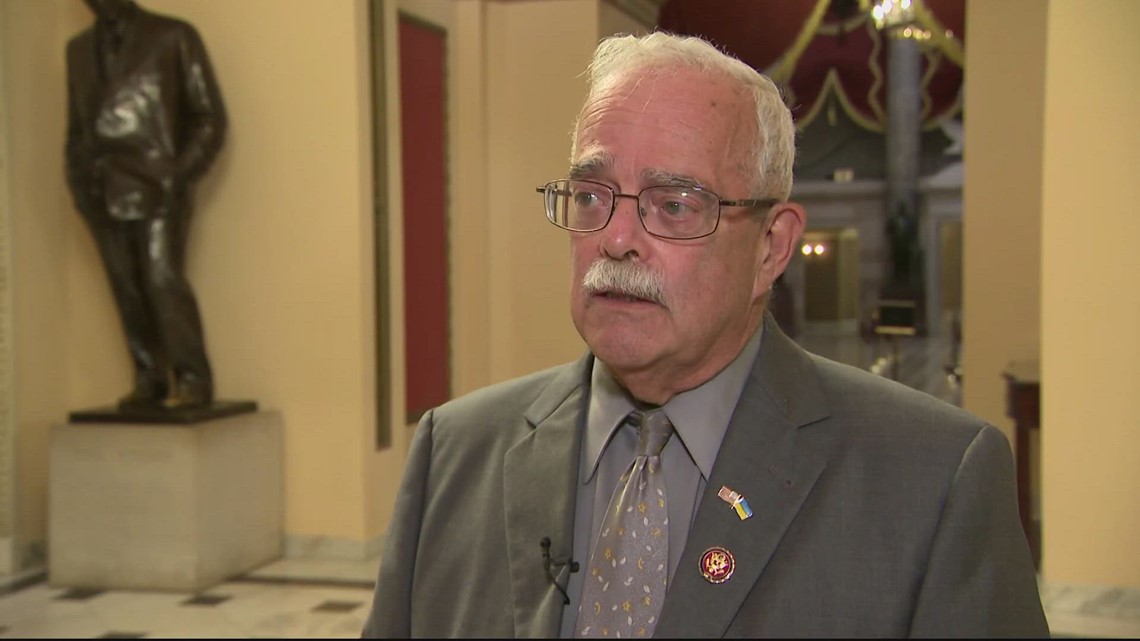

On May 18, two members of Congress – Rep. Abigail Spanberger (D-Va.) and Rep. Brian Fitpatrick (R-Pa.) – introduced legislation to specifically require the Treasury not pay members of Congress during a default or shutdown, but it remains unclear to what extent even that is technically feasible, if it were to pass.

A default is significantly different from a shutdown. A shutdown occurs when Congress does not pass an annual appropriations bill, meaning there is no approved spending (besides “mandatory” programs like Social Security which have a separate funding source). During a default, the spending has already been approved by Congress and the government is therefore legally obligated to make those payments, but it cannot because it has run out of money.

The VERIFY team works to separate fact from fiction so that you can understand what is true and false. Please consider subscribing to our daily newsletter, text alerts and our YouTube channel. You can also follow us on Snapchat, Twitter, Instagram, Facebook and TikTok. Learn More »

Follow Us

Want something VERIFIED?

Text: 202-410-8808

.png)

English (US) ·

English (US) ·