The deal allows owners to cash in on the soaring value of their teams while retaining control of them.

EAGAN, Minn — The NFL has finally relaxed a few of its strict rules around team ownership, formally approving the entry of private equity funds into the equation.

Owners voted on Tuesday at a special meeting in Minnesota to allow up to 10% stakes in individual clubs by investment groups, an emerging trend in the financial world that the league was content to let other pro sports take the lead on while it carefully took notes and considered how it might integrate the practice into its booming business for the good of all 32 teams.

While questions remain about how many more potential buyers might be able to get in the game beyond the initial group of approved firms, it's clear as always that the NFL would not have gone down this road if it didn't think it could benefit its booming business with the stated goal of generating $25 billion in annual revenue.

What is private equity anyway?

It's a method for companies that aren't publicly traded to increase their value and liquify assets for various purposes. The firms that are in business for this practice pool cash from individual investors to strategically buy stakes in certain businesses with the promise, or hope, of a lucrative return.

Why did the league wait until now to do this?

The NFL has long prided itself on the single-owner structure that has seen several prominent franchises stay in the same family for generations and was careful to preserve its restrictive parameters. Controlling owners must own at least 30% of the team, and no more than 25 owners can be part of an ownership group. Five years ago, when private equity began to pick up in MLB, MLS, the NBA and the NHL, the NFL started studying the issue but didn't accelerate the plan until last year.

What was the motivation to make it happen this year?

Recent sales of the Denver Broncos ($4.65 billion) and Washington Commanders ($6.05 billion) further illustrated the opportunity for current owners to cash in on the soaring values of their teams while still remaining in control of them. When a new majority owner does take over, such transactions are increasingly expensive and difficult with a 25-owner limit for prospective owners without potential cash boost sources like these private equity firms. Plus, the league realized how strong the appetite is on the private market for NFL investment.

“The support today in the room was very strong for this decision,” Broncos owner Greg Penner said. “One thing that was really important was giving owners a different option for capital sources but at the same time maintaining how we operate.”

Who made the cut?

The NFL permitted only four different groups to enter the arena: standalone firms Arctos Partners, Ares Management Corp. and Sixth Street, plus a consortium of five funds — Blackstone, Carlyle, CVC, Dynasty Equity and Ludis. The approved list could well be extended in the future, but these selections from the initial vetting process were made based on having the cash ready to go right away. Ludis was founded by Pro Football Hall of Fame running back Curtis Martin, who spearheaded the collaboration as part of his effort to include minority investors in NFL ownership positions.

What could possibly go wrong?

The LIV Golf league controversy raised awareness and concern about the ethics, motives and tactics of sovereign wealth funds like the one that helped form the splinter group on the links. The NFL has tried to protect itself from such investment by limiting individual investment in one of the approved funds to 7.5%. There are also other key provisions designed to keep this process under control and not a wild west of money and influence flying around the league.

Multiple funds can account for the 10%, but there’s a 3% minimum investment for each. Each purchase must be held for a minimum of six years. There’s a maximum of six teams that each of the approved funds can invest in, and no more than 20% of each fund can go to one NFL club. League owners and their families are allowed to invest their own wealth in these funds, but only up to 3% of them.

While these deals will certainly make the richest of the rich even richer, more cash on hand gives NFL clubs more resources to spend on the product and the experience for the benefit of the consumer. And in case fans are worried a wealthy backer of a rival club will buy into their favorite team and become some kind of spy, these are strictly passive investments.

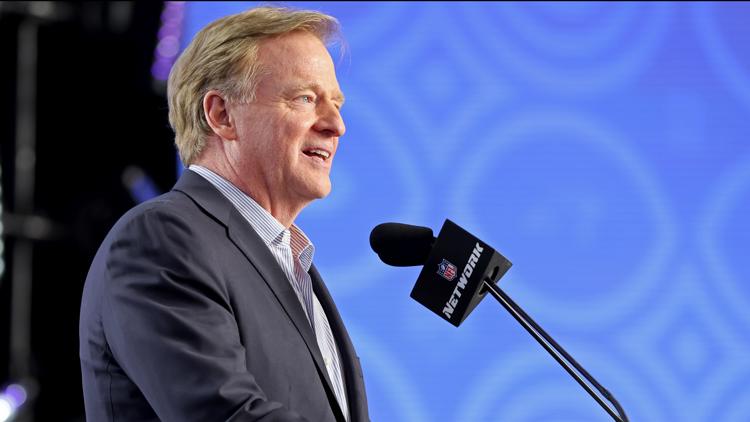

“All it is is a silent position that would allow access to capital for those teams that wish to offer 10% of their team,” Commissioner Roger Goodell said. “They will not be in any kind of decision-making influence in any way.”

.png)

English (US) ·

English (US) ·